nassau county property tax rate 2021

Falls Church city collects the highest property tax in Virginia levying an average of 094 of median home value yearly in property taxes while Buchanan. Virginia is ranked 29th of the 50 states for property taxes as a percentage of median income.

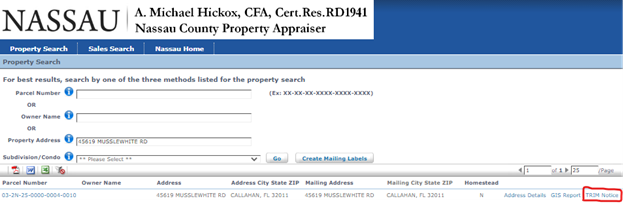

Nassau County Ny Property Tax Search And Records Propertyshark

The exact property tax levied depends on the county in Virginia the property is located in.

. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Cook County collects on average 138 of a propertys assessed fair market value as property tax. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

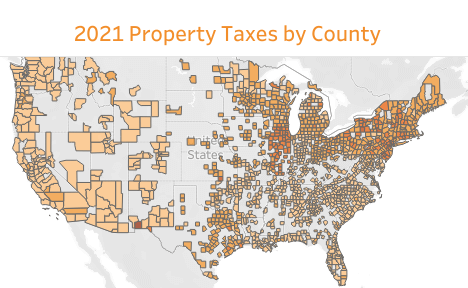

Attom Single Family Home Property Taxes Increased To 328 Billion In 2021 Mortgageorb

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes In Nassau County Suffolk County

2022 Property Taxes By State Report Propertyshark

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

New York Property Tax Calculator Smartasset

6 Ways You Can Build Your Credit Quick Build Credit Mortgage Florida Home

Property Taxes In Nassau County Suffolk County

Receiver Of Taxes Town Of Oyster Bay

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Tax Collector For Polk County Service Centers Will Be Closed Monday For Labor Day Polk County Tax Collector

New York Property Tax Everything You Need To Know

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New York Property Tax Calculator 2020 Empire Center For Public Policy